Welcome to weekly edition of The Semiconductor Newsletter. This edition for week 28 highlights strong global sales, rapid revenue expansion, and major funding milestones across the semiconductor landscape. Here the titles:

1. Global Semiconductor Market Reaches $59 Billion in May with 19.8% Annual Growth: sales rose across all regions, with the Americas and Asia Pacific leading the increase.

2. United States Semiconductor Industry Forecasted to Reach $701 Billion in 2025: policy, investment, and capacity expansion drive growth amid global competition.

3. TSMC Reports 40% Revenue Surge in First Half of 2025 Amid Strong AI Demand: expansion plans and AI chip supply reinforce strategic industry position.

4. Nvidia Becomes First Public Company to Cross $4 Trillion Market Value: strong demand for AI accelerators and cloud infrastructure continues to rise.

5. U.S. Tariff Policy Creates Strategic Uncertainty for European Semiconductor Sector: cross-border cost implications highlight the need for supply chain adaptation.

6. Dai Nippon Printing Launches First Overseas R&D Center in the Netherlands: joint research in Co-Packaged Optics focuses on next-generation data transmission.

7. Arago Raises $26 Million to Accelerate Photonic AI Chip Development: photon-based processing aims to reduce energy consumption in large-scale AI.

📖 Read the full edition below. Follow The Semiconductor Newsletter for continuous updates across the global semiconductor industry.

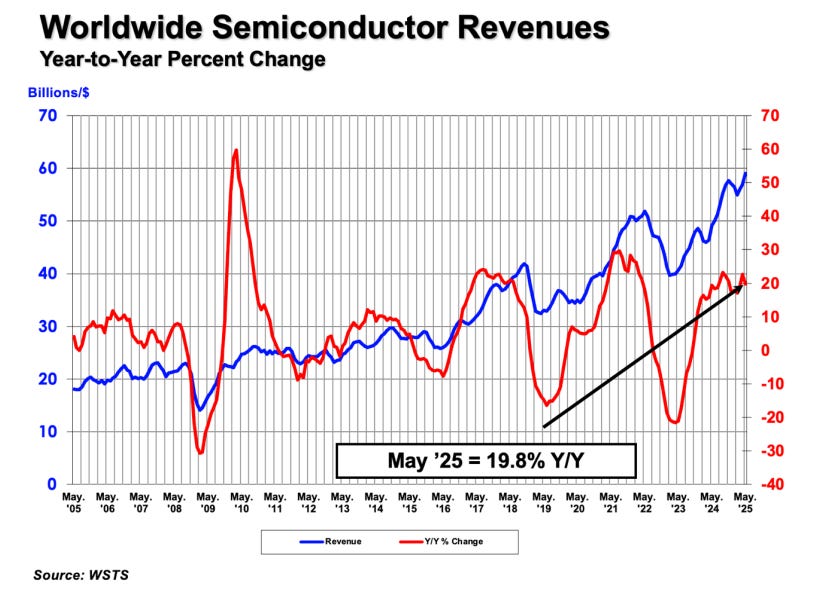

1. Global Semiconductor Market Reaches $59 Billion in May with 19.8% Annual Growth

Sustained Momentum Across All Regions

Global semiconductor sales reached $59.0 billion in May 2025, according to the Semiconductor Industry Association, marking a 19.8% increase from the $49.2 billion recorded in May 2024. This also represents a 3.5% increase compared to April 2025. The data, compiled by the World Semiconductor Trade Statistics (WSTS), is based on a three-month moving average. The growth was led by robust demand across key regions, especially in the Americas and Asia Pacific.

Regional Breakdown and Month-to-Month Dynamics

Sales in the Americas surged by 45.2% year-over-year, while Asia Pacific/All Other grew by 30.5%, and China by 20.5%. Japan and Europe posted more modest gains at 4.5% and 4.1%, respectively. Month-to-month, Asia Pacific/All Other led with 6.0% growth, followed by China (5.4%), Europe (4.0%), the Americas (0.5%), and Japan (0.2%). The continued expansion reflects persistent demand in segments such as AI, automotive, and industrial electronics.

2. United States Semiconductor Industry Forecasted to Reach $701 Billion in 2025

Global Sales Growth and Strategic Investment Initiatives

The Semiconductor Industry Association's 2025 State of the Industry report highlights that global semiconductor sales reached $630.5 billion in 2024 and are projected to grow 11.2% to $701 billion in 2025, driven by demand from AI, 5/6G, and autonomous technologies. The United States industry has responded with over $500 billion in announced private-sector investments, setting the stage to triple domestic chip manufacturing capacity by 2032 and support over 500,000 jobs across the ecosystem.

International Competition and Policy Influence

Governments worldwide are offering significant incentives to strengthen domestic semiconductor capabilities, reinforcing the strategic importance of the industry. In this competitive global environment, the advancement of sound policy—including tax, workforce, and trade frameworks—is essential. The report emphasizes that decisions made in 2025 will determine the pace of innovation, supply chain resilience, and the long-term global position of the United States semiconductor sector.

Linke REPORT

3. TSMC Reports 40% Revenue Surge in First Half of 2025 Amid Strong AI Demand

First-Half Revenue Climbs Despite Monthly Decline

Taiwan Semiconductor Manufacturing Company (TSMC) posted a 40% increase in revenue for the first half of 2025, reaching NT$1.77 trillion ($60.5 billion), up from NT$1.26 trillion in the same period in 2024. June 2025 revenue totaled NT$263.71 billion ($9.02 billion), showing a 27% year-over-year rise but an 18% decline from May, reflecting monthly fluctuations despite robust overall performance.

U.S. Expansion and Strategic Positioning in AI Supply Chain

TSMC continues to expand its manufacturing presence in the United States with a $100 billion investment initiative, announced alongside government support. The company is a critical supplier for high-performance AI processors, including chips for Nvidia. CEO C.C. Wei expects record revenue in 2025, citing strong AI-related demand and minimal impact from tariffs, which are largely absorbed by downstream importers.

4. Nvidia Becomes First Public Company to Cross $4 Trillion Market Value

Market Capitalization Milestone and AI Infrastructure Leadership

Nvidia briefly surpassed $4 trillion in market capitalization, outpacing Apple and Microsoft. This milestone reflects its central role in AI infrastructure, where its graphics processing units power data centers operated by Microsoft, Google, and Amazon. Nvidia shares rose nearly 21% in 2025 and have gained 74% since early April, despite mid-year volatility triggered by geopolitical concerns and competition.

Revenue Growth and Strategic Developments in AI Hardware

The company reported $44.1 billion in revenue for the quarter ending April 2025, up 69% from the previous year. Nvidia's new Blackwell Ultra chip aims to enhance AI model efficiency and performance. CEO Jensen Huang is actively engaged with global tech and policy initiatives, including Project Stargate, a $500 billion AI infrastructure project. Analysts project Nvidia may reach a $6 trillion market cap by 2028, reinforcing its dominant position in AI semiconductor innovation.

5. U.S. Tariff Policy Creates Strategic Uncertainty for European Semiconductor Sector

Tariff Complexity and Global Supply Chain Disruption Risks

The Trump administration's evolving tariff strategy, which includes pauses, exemptions, and up to 40% duty on certain chip imports, has generated significant uncertainty for the global semiconductor industry. European firms with cross-border production—especially those with packaging or fabrication in China—face increased costs. For example, a $100 chip with minor post-processing in China could incur total import costs as high as $140 when re-entering the United States.

Real-Time Scenario Planning and Digital Supply Chain Modeling

To address ongoing volatility, European semiconductor firms are turning to real-time supply chain modeling, including digital twins and AI-driven scenario analysis. These tools support multi-enterprise visibility and network optimization, helping companies simulate tariff impacts, adjust sourcing strategies, and minimize logistics disruptions. The integration of these technologies is critical for adapting to shifting trade environments and maintaining competitiveness across international operations.

6. Dai Nippon Printing Launches First Overseas R&D Center in the Netherlands

Strategic Investment in Photonic Integration and Co-Packaged Optics

Dai Nippon Printing (DNP) will open its first overseas R&D center at High Tech Campus Eindhoven in September 2025. The initiative focuses on Co-Packaged Optics, a next-generation semiconductor technology integrating optical and electronic circuits. DNP signed a joint research agreement with the Netherlands Organization for Applied Scientific Research (TNO) and will collaborate with the Photonic Integration Technology Centre (PITC).

R&D Roadmap for Energy-Efficient Data Center Technologies

With generative AI and digital transformation increasing global data volumes, the power consumption of data centers is a critical issue. Co-Packaged Optics technology offers high-speed, low-energy optical transmission solutions. DNP plans a three-year R&D effort to advance optical circuit patterning and develop package components compatible with photonic-electronic integration. The center will serve as a platform for open innovation, leveraging Europe's photonics ecosystem and accelerating the commercialization of optical semiconductor technologies.

7. Arago Raises $26 Million to Accelerate Photonic AI Chip Development

Photon-Based Architecture Targets Energy Efficiency at Scale

Arago, a deep-tech startup based in Paris and Silicon Valley, secured $26 million in seed funding to commercialize its photonic processor, JEF. The chip processes data using photons instead of electrons, reducing energy consumption by up to 90% compared to traditional GPUs. Early backers include Earlybird, Visionaries Tomorrow, and a range of industry veterans from Arm, Datadog, and Nvidia.

Global Deployment Strategy and AI Workload Integration

JEF is designed for seamless integration into existing AI infrastructures, supporting standard software stacks and avoiding compatibility bottlenecks. Arago operates across France, North America, and Israel, with a team of 20 engineers and scientists. The company aims to address the growing energy demands of AI workloads in data centers, offering a scalable and sustainable solution for sectors including healthcare, defense, and climate modeling. The funding will support product refinement, hiring, and business expansion across global markets.